Why It Matters Now More Than Ever

In today’s healthcare environment, managing paperwork is tough—but letting your malpractice insurance lapse is even tougher. For doctors, managers, and clinic owners, keeping this coverage up-to-date isn’t just a checkbox—it’s a direct line to your ability to practice and get paid.

What’s Malpractice Insurance?

It’s liability protection for healthcare professionals. If a claim of negligence arises, it covers legal costs and damages. Without it, you’re exposed to both legal and financial trouble.

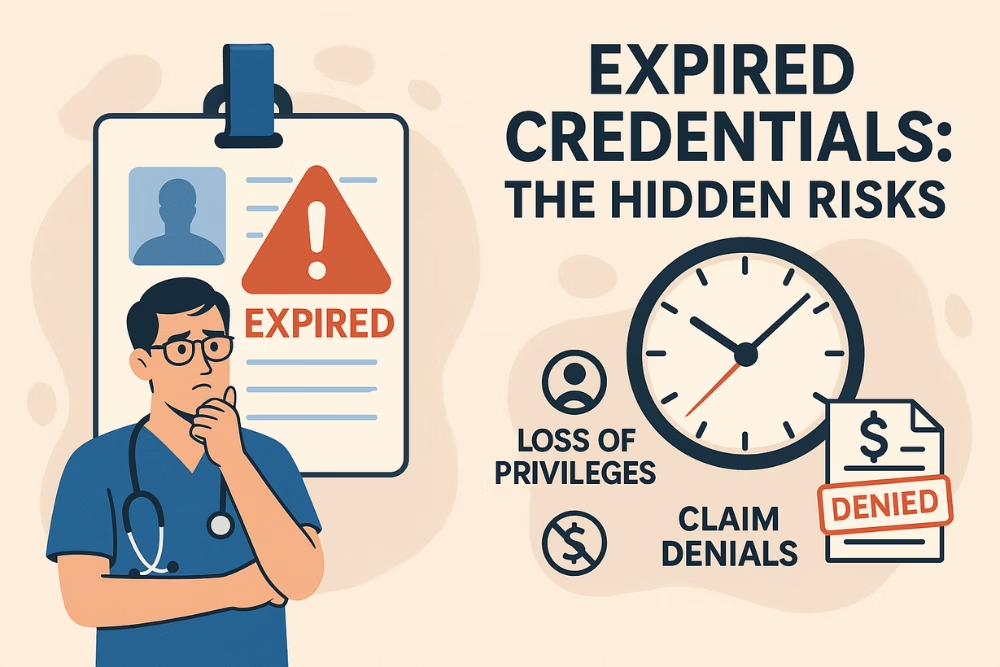

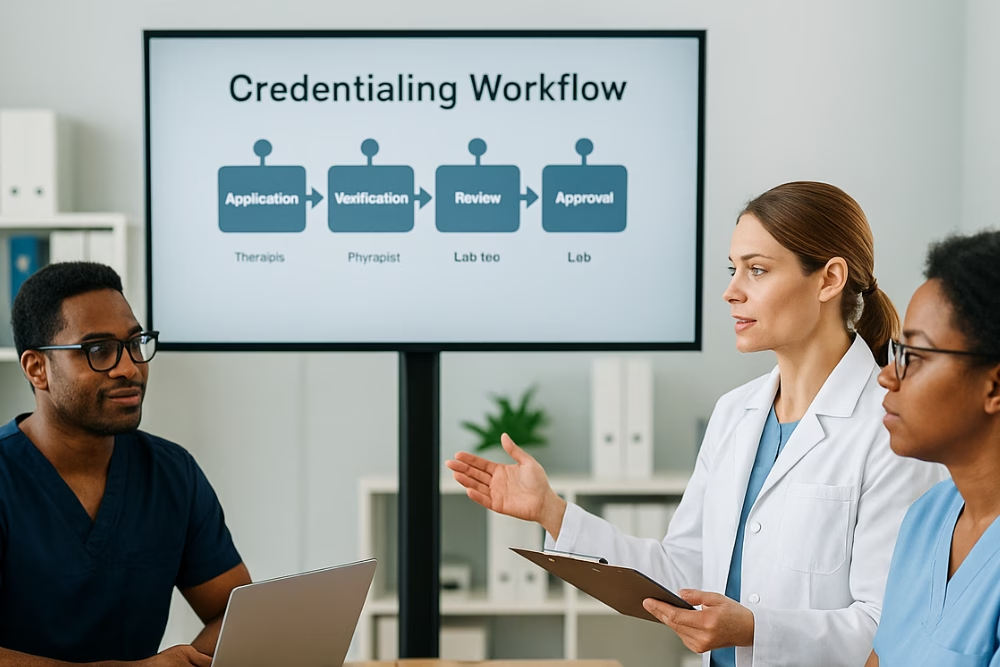

Credentialing Depends On It

Credentialing verifies your qualifications for hospitals and insurance networks. Without current malpractice insurance, you’re stalled. Here’s why:

-

Access Denied: Most hospitals and networks reject applications without active malpractice coverage.

-

Professional Reputation: Up-to-date policies show you’re compliant and care about safety.

-

Cash Flow Killer: Lapsed coverage can delay claims, leading to major cash-flow disruptions.

-

Legal Vulnerability: Even a few days of lapsed coverage can expose you if a patient complaint arises.

-

Credentialing Speed: Current documents help accelerate approvals, so you can see patients and earn income faster.

-

Stay In-Network: Without it, you lose insured patient traffic.

Real Example

Dr. Alyse missed renewing her policy by four days. A minor complaint arose during that window. The insurer delayed her onboarding. She lost revenue, time, and credibility—all from a tiny oversight.

Be Proactive. Stay Covered.

Credentialing delays hurt your bottom line and credibility. Don’t let it happen to you. Make malpractice insurance management part of your core operations.

Let eClinicAssist Handle It for You

Tired of tracking expiration dates and credentialing red tape? eClinicAssist manages your malpractice renewals, handles documents, and speeds up your onboarding.